6 03 2698 8044 extensions 8982 7706 Note. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Once you are on the e-Dafter page click on Pendaftaran Individu for individual.

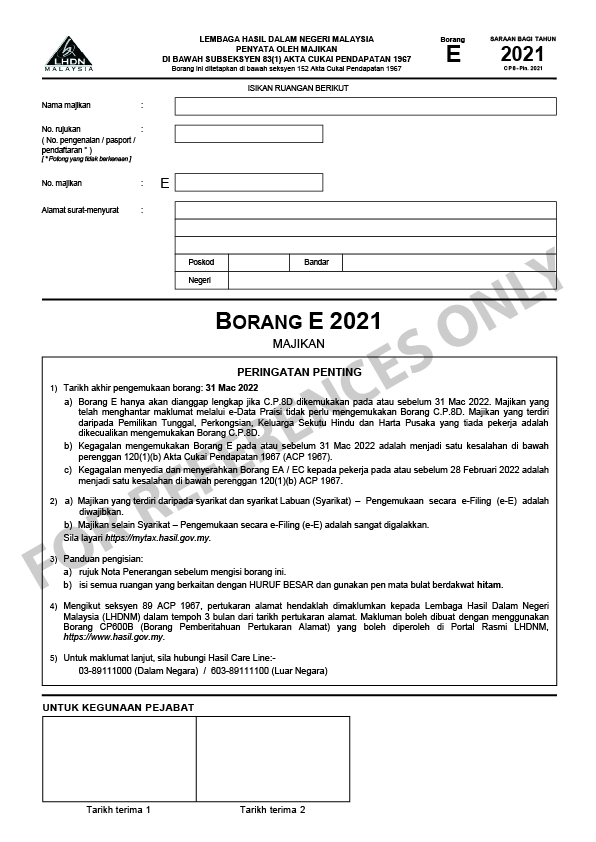

. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. Submit form E to LHDN via e-filing. To prepare Form E for printing for electronic filing you can refer to the guide below or follow these steps.

The deadline for submitting Form E is March 31. Go to Payroll Payroll Settings Form E. In this video you will be guided on how to generate th.

Before submitting you will need to sign off the Declaration form. Internal Revenue Service Center Attn. Cross-check all E forms information to.

Hwo to make borang ea via online lhdn. April 30 for manual submission. Send EA form to all employees online submission of Borang E CP8D to LHDN in just 1 click.

As an example for CPD activities in 2018 the deadline for submitting CPD claim for 2018 to the myCPD system is 31st January 2019. Butang Simpan Cetak Pengesahan - Untuk menyimpan dan mencetak slip pengesahan penerimaan borang. Click Create Form E for 2021.

Ea Form Sample Fill Online Printable Fillable Blank Pdffiller. What If You Fail To Submit Borang E and CP8D. Borang E contains information like the company particulars and details of every employees earnings in the company.

Under e-Form tab head to Non-Individual e-E section and select the correct Year of Assessment. The earnings that are to be included in CP8D form should be shown in. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

I Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form. ðIsikan 0 di Bahagian A dan Bahagian B Borang E 2010. Form E submission process.

Sistem online e-Submission merupakan inisiatif MPOB di dalam menyediakan perkhidmatan penghantaran Penyata Bulanan Pengeluar Buah Kelapa Sawit - MPOB EL ET4 bagi kategori estet dengan mudah cepat dan selamat selewat-lewatnya pada 7 haribulan pada bulan berikutnya. Please note that the website is available in. May 15 for electronic filing ie.

Collect payments customer data registrations event RSVPs and leads with our. What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News When the taxable person contravenes the provisions of sections 17 17A 18 19 subsections 1 and 2 of section. The CP8D txt file will need to be uploaded during online filing of the E form.

E Tax at Date of Death Rates for Prior Gifts. Go to Payroll Payroll Settings Form E. Form E is an employee income declaration report that employers have to submit every year.

Million Payroll System - Step-by-Step GuidanceMeet problem while performing E-submission for Borang E. Untuk makluman segala maklumat peribadi yang dikongsikan melalui e-Submission. All companies Sdn Bhd must submit online for 2018 Form E and.

Muat Turun Layout Maklumat Praisi. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. Select e-Borang under e-Filing.

Comprehensive HR Management Reports View payroll summary yearly payroll report appointment letter confirmation letter increment letter many more. Online application is available from 700 am to 900 pm on Sunday. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021.

ðMenghantar surat makluman ke Cawangan di mana fail Majikan berada untuk tindakan supaya Borang E tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula. Once you have done this step click on Download Form E. Any dormant or non-performing company must also file LHDN E-Filing.

The deadline for filing tax returns in Malaysia has always been. If you are filing the E form online the pdf file is for your information only to help you fill the details in the online form. The Borang E must be submitted by the 31st of march of every year.

Ia adalah untuk memudahkan pembayar cukai menggunakan e-Filing di mana praisi prefill telah dibuat pada borang e-Filing. Apabila pembayar cukai menggunakan e-Filing maklumat tersebut boleh dipinda jika terdapat sebarang perubahan sebelum tandatangan dan hantar borang secara elektronik. ðBorang E yang diterima itu perlu dilengkapkan dan ditandatangani.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read. Once logged in head to Services e-Filing and select e-Form.

Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. April 30 for manual submission. Login to httpsezhasilgovmyCI from 1 March.

Email confirmation from LHDN. Registering as a first-time taxpayer on e-Daftar. All companies must file Borang E regardless of whether they have employees or not.

All partnerships and sole proprietorships must now. In addition every employer shall for each calendar year prepare and render to. All companies Sdn Bhd must submit online for 2018 Form E and.

Cross-check all E forms information to make sure everything is in order and written correctly. Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co. IRBM LHDN will not entertain or accept any companies E filling 2021 that submit their Form E by hand or by mail.

For more information about Form EA Form E and other tax forms please refer to LHDNs official website.

How To Submit Borang Cp8d E Filing Sql Payroll English Ver Youtube

How To Step By Step Income Tax E Filing Guide Imoney

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

What Is Borang E Every Companies Need To Submit Borang E Otosection

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Check Balik Result List Dengan Borang Permohonan Application Form List Contact Case

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

What Is Borang E Every Companies Need To Submit Borang E Otosection

Otopass Lhdn Has Released Year 2020 Borang E Borang Facebook

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Companies Need To Submit Borang E Otosection